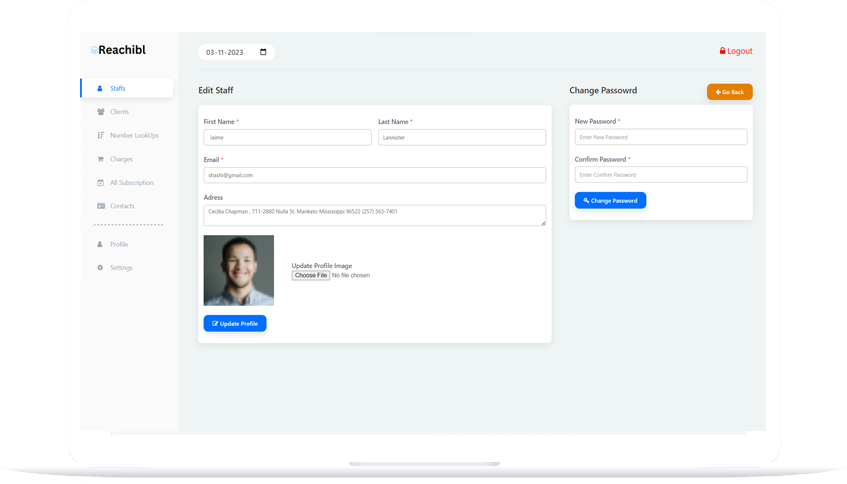

Reporting a revolving account to Experian through Reachibl can significantly enhance a customer's business credit profile. By accurately documenting the usage and timely payments associated with a revolving account, businesses establish a robust credit history.This positive credit history is crucial for demonstrating financial responsibility and reliability to potential lenders and suppliers. When this information is reported to Experian, the largest business credit bureau, it becomes part of the business's credit report. A favorable credit report can lead to higher credit scores, which in turn can increase the likelihood of approval for loans and credit lines. Access to additional credit can empower businesses to invest in growth opportunities, expand their operations, and better manage their cash flow. Moreover, a strong credit profile can also lead to more favorable terms and lower interest rates, saving the business money in the long run. Overall, reporting a revolving account to Experian through Reachibl provides businesses with the financial leverage they need to thrive and succeed.

Grow business with

Reachibl

We have collected the best offers of credit institutions. Reachibl all-inclusive service is a cost effective to scrub your data maximum deliverability. Our platform offers many features that will increase the effectiveness of marketing campaigns, including SMS and email delivery! With our platform you'll have access to many features designed marketing professionals looking maximize the potential of what's available in today’s digital world! Reachibl is the only scrubbing platform that offers an all-inclusive solution to help improve marketing efforts. Our service helps clean your data files maximum deliverability, so it's easy and efficient!